The Parable of 10 Men in a Bar

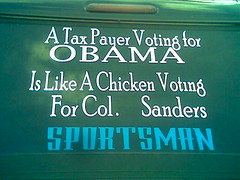

from: http://itooktheredpill.wordpress.com/2008/10/22/the-parable-of-10-men-in-a-bar/Not a Bible parable, obviously, but one of the best analogies I've ever seen to explain the downfall of Socialist taxation policies.

Suppose that every day, ten men go out for beer and the bill for all ten comes to $100. If they paid their bill the way we pay our taxes,it would go something like this:

The first four men (the poorest) would pay nothing.

The fifth would pay $1.

The sixth would pay $3.

The seventh would pay $7.

The eighth would pay $12.

The ninth would pay $18.

The tenth man (the richest) would pay $59.So, that's what they decided to do.

The ten men drank in the bar every day and seemed quite happy with the arrangement, until one day, the owner threw them a curve. 'Since you are all such good customers,' he said, 'I'm going to reduce the cost of your daily beer by $20.' Drinks for the ten now cost just $80.

The group still wanted to pay their bill the way we pay our taxes so the first four men were unaffected. They would still drink for free.

But what about the other six men - the paying customers? How could they divide the $20 windfall so that everyone would get his 'fair share?'

They realized that $20 divided by six is $3.33. But if they subtracted that from everybody's share, then the fifth man and the sixth man would each end up being paid to drink his beer. So, the bar owner suggested that it would be fair to reduce each man's bill by roughly the same amount, and he proceeded to work out the amounts each should pay.

And so:

The fifth man, like the first four, now paid nothing (100%savings).

The sixth now paid $2 instead of $3 (33%savings).

The seventh now pay $5 instead of $7 (28%savings).

The eighth now paid $9 instead of $12 (25% savings).

The ninth now paid $14 instead of $18 (22% savings).

The tenth now paid $49 instead of $59 (16% savings).Each of the six was better off than before. And the first four continued to drink for free. But once outside the restaurant, the men began to compare their savings.

'I only got a dollar out of the $20,'declared the sixth man. He pointed to the tenth man,' but he got $10!'

'Yeah, that's right,' exclaimed the fifth man. 'I only saved a dollar, too. It's unfair that he got ten times more than I got'

'That's true!!' shouted the seventh man. 'Why should he get $10 back when I got only two? The wealthy get all the breaks!'

'Wait a minute,' yelled the first four men in unison. 'We didn't get anything at all. The system exploits the poor!'

The nine men surrounded the tenth and beat him up.

The next night the tenth man didn't show up for drinks so the nine sat down and had beers without him. But when it came time to pay the bill, they discovered something important. They didn't have enough money between all of them for even half of the bill!

And that, ladies and gentlemen, journalists and college professors, is how our tax system works!!

The people who pay the highest taxes get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up anymore. In fact, they might start drinking overseas where the atmosphere is somewhat friendlier.

[Found on Internet, here's what Snopes has to say about the authorship. Regardless of who wrote it, it explains the concepts very well.]

"Spreading the wealth around" never results in a better outcome for people. It always results in destruction. Case study: Zimbabwe.

The thief does not come except to steal, and to kill, and to destroy. I have come that they may have life, and that they may have it more abundantly.

Jesus said to him, "I am the way, the truth, and the life. No one comes to the Father except through Me.

October 22, 2008 at 9:24 pm

I heard this first on Rush's show and thought it a very appropriate analogy. Wish more ppl knew about it - pass it on -

October 22, 2008 at 11:17 pm

This is great!!! It's so simple…yet BHO just doesn't get it. Or…perhaps he does…get us all drunk (for free) and have his way with us. Count me out!!

October 23, 2008 at 11:20 am

While sitting at our coffee table with my 8th grader studying for an upcoming test, political news was on the t.v. in the background. My son was observing the treatment of "Joe the Plumber" and asked why people (media) were bashing him for asking a question. After my explanation, my son remarked, "Mom, that would be like me making 100 on my test, a classmate making a 25, my teacher taking points away from me, and giving them to the other student all so that our grades would be equal. But then we'd both fail."

I replied, "Yes, but maybe that would be fair." To which he replied, "Or maybe he/she didn't study, or better yet, didn't even care to study because he/she knew they would get some of my points. In that case, why should I study?" To which I replied, "Bingo son, you get it."

P.S. Bless you for the "shout out" on MM! You're terrific! I understand that this time of year she would be inundated with trolls, so I will continue to read and learn.

October 23, 2008 at 12:10 pm

sweetakin,

Your son is wise! You have taught your children well.

Thank you for your kind words.

Sincerely,

Red Pill.